Analysis and Forecast of Market Prospect of Broiler breeding Industry in China

I. basic general situation of broiler breeding industry

The broiler industry is a pluralistic intergenerational animal linked by a number of closely related vertical blood relationships.

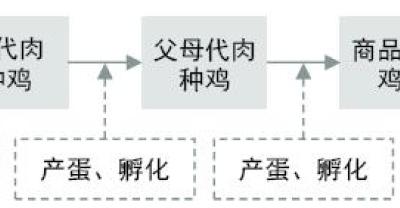

Poultry industry, from Zengzu broiler breeder, parental broiler breeder, commercial broiler to chicken products is a complete and systematic breeding process. The details of the broiler breeding process are as follows:

In China, broilers mainly include two categories: yellow-feathered broilers and white-feathered broilers. Yellow-feathered broiler is a local breed with local breed, which usually has strong regional characteristics, and the price is higher than that of white-feathered broiler. Yellow feather broiler breeding enterprises are mainly faced with regional competition. On the other hand, white feather broilers are all imported breeds with low prices, and breeding enterprises are facing competition from the international market.

1. White feather broilers

As an imported breed, white feather broiler belongs to fast large broiler, and its coat color is mostly white. Compared with yellow-feathered broilers, it is characterized by faster growth, higher feed conversion rate and more meat production, which is suitable for industrial large-scale production, but the taste is not good. The main breeds of white feather broilers introduced in China include AA+, Ross 308, Kobao Avian, Hubbard and so on. According to the statistics of the China Poultry Industry Development report (2016), AA+ introduced 193300 sets in 2016, accounting for 29.80% of the total; Ross 308 introduced 234800 sets, accounting for 36.20% of the total; Kobao Avian introduced 131500 sets, accounting for 20.27% of the total; and Hubbard introduced 89000 sets, accounting for 13.72% of the total. White feather broiler is not only an important part of broiler products in China, but also the main raw material for broiler slaughtering and processing enterprises.

The ancestral breeder chicken breeding enterprises of white feather broiler in our country mainly introduce the ancestral meat breeder chicken seedlings from abroad, breed the parent meat breeder chicken seedlings and sell them to the parent broiler breeder enterprises, and the parent broiler breeders hatch the commercial generation chicks and sell them to the generation breeders. The commercial generation broilers become chicken products after slaughtering and processing. The target customers of Baiyu broiler are mainly fast food consumption and export of split products such as KFC and McDonald's.

2. Yellow feathered broilers

Yellow feather broiler is a high-quality broiler breed bred by excellent local breeds in China, with a national yield of nearly 100%. Yellow feather broilers mainly include yellow feathers, hemp feathers and other colored feathers. The development of yellow-feathered broilers in Guangdong and Guangxi is relatively early and has distinct regional representation in the industry. Compared with white-feathered broilers, yellow-feathered broilers have the characteristics of smaller body weight, long growth cycle, strong disease resistance and delicious meat. Their body appearance is in line with the preferences and consumption habits of Chinese consumers, so it is more suitable for live chicken sales, especially for Chinese cooking. Due to the characteristics of yellow feather broiler, it is not suitable to sell to KFC, McDonald's and other fast food chains. The main markets of yellow feather broilers are concentrated in southern China and Hong Kong and Macao, and the target customers are mainly household consumption, canteens and hotels of enterprises and institutions. Although the production and consumption of yellow-feathered broilers in China have obvious regional characteristics, with the rapid development of e-commerce and logistics industry, the trend of northward extension and expansion of the market has appeared.

II. Production and consumption of chicken in the world

In recent years, chicken production and sales showed a rapid upward trend. According to USDA statistics, world chicken production has maintained steady growth, from 65.55 million tons in 2006 to 90.18 million tons in 2017, with an average annual compound growth rate of 3.24%. World chicken consumption increased from 71.95 million tons in 2006 to 89.21 million tons in 2017, with an average annual compound growth rate of 1.5 percent.

World Chicken production and consumption trend Chart

Data source: USDA, China Business Industrial Research Institute

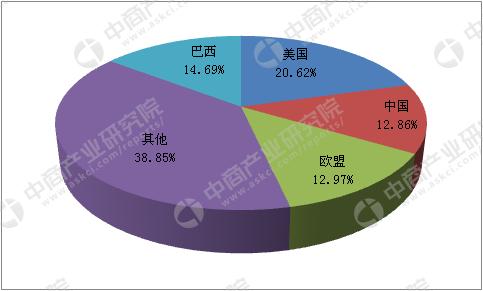

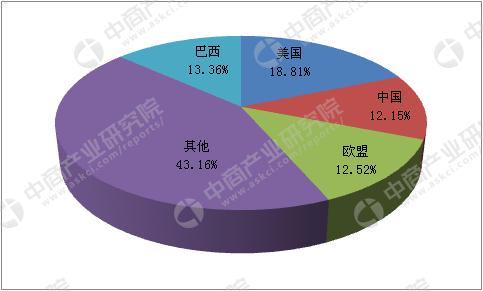

From the perspective of regional distribution, the top three chicken producing and consuming countries in the world are the United States, China and Brazil. The United States is the largest producer of chicken in the world. According to USDA statistics, in 2017, chicken production in the United States reached 18.596 million tons, accounting for 20.62 percent of global chicken production; China's chicken production reached 11.6 million tons, accounting for 12.86 percent of global chicken production; and Brazilian chicken production reached 13.25 million tons, accounting for 14.69 percent of global chicken production. Brazil has overtaken China in chicken production since 2016 to become the second largest chicken producer. In 2017, chicken consumption in the United States, China and Brazil was 18.667 million tons, 12.05 million tons and 13.252 million tons respectively, accounting for 18.81%, 12.15% and 13.36% of the total global chicken consumption.

The proportion of chicken production in the world's major chicken producing countries in 2017

Source: US Department of Agriculture, China Business Industry Research Institute

Percentage of chicken consumption in the world's major chicken consuming countries in 2017

Data source: USDA, China Business Industrial Research Institute

Although the world chicken production and consumption are on the rise as a whole, the growth rate of chicken production and consumption has declined significantly in recent years. Chicken production and consumption grew at an average annual rate of about 4 per cent from 2009 to 2012, but the growth rate of global chicken production and consumption has slowed to less than 2 per cent since 2013. The epidemic disease, especially the H7N9 epidemic, is still an important factor in restraining the growth of chicken production and consumption.

III. Production and consumption of Chicken in China

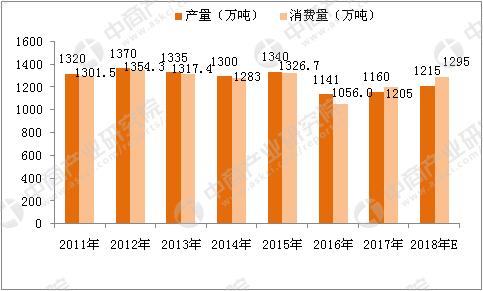

Since 2004, plagued by the H7N9 epidemic and the rapid rise in costs and other factors, Chinese chicken production has entered a period of steady development, although the growth rate has slowed down, but the growth trend is still strong. From 2004 to 2012, the annual chicken production and consumption in China continued to increase. Due to the epidemic situation and the eight regulations of the central government and other factors, the annual chicken production and sales decreased slightly since 2013, but always maintained at the level of more than 11 million tons. Chicken production increased from 11.291 million tons in 2007 to 11.6 million tons in 2017, and chicken consumption increased from 11.773 million tons in 2007 to 12.05 million tons in 2017. According to the China Poultry Industry Development report released by the China Animal Husbandry Association, there were about 3.907 billion yellow-feathered broilers in 2016, with an average weight of 1.5kg per feather. it can produce about 3.81 million tons of yellow-feathered chicken (based on 65% eviscerated rate).

Trend chart of chicken production and consumption in China

Data source: USDA, China Business Industrial Research Institute

Because there are many and scattered participants in the breeding industry, poultry prices fluctuate periodically with the changes in the relationship between supply and demand: due to the short feeding time and the rising price, retail investors quickly enter and implement irrational supplementary hurdles, which leads to oversupply, poultry prices fall, and some retail investors withdraw from the industry at a loss. The mood of subsequent supplementary hurdles is affected and supply decreases.

Take broiler as an example, the broiler industry experienced about four cycles from 1999 to 2013, each lasting about 2 to 3 years. According to historical data, the growth rate of live yellow-feathered broilers decreased to varying degrees in 2001, 2004, 2006 and 2009 respectively. According to the statistics of the China Animal Husbandry Association, chicken prices have increased by 23.33%, 35.21%, 72.22% and 37.23% respectively in these stages. The decrease in chicken supply will lead to an increase in chicken prices. Under the heavy blow of the H7N9 epidemic, the yellow-feathered broiler industry was hit hard in April 2013 and early 2014. Small and medium-sized enterprises with high breeding costs and weak financial strength closed down, and the total output of yellow-feathered broilers declined, prompting the market to pick up from April to December 2014.

IV. Broad prospects for domestic chicken consumption market

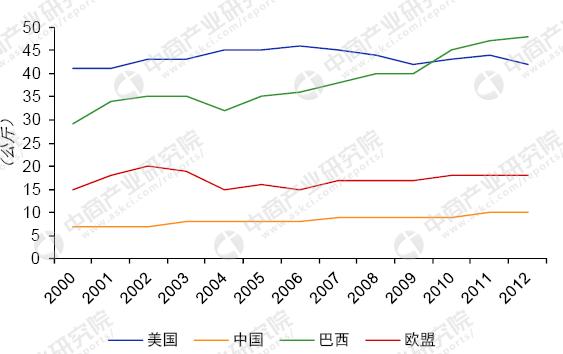

The total amount of chicken consumption in China ranks second in the world, but there is still a big gap in per capita consumption compared with other big chicken consumption countries. China's per capita chicken consumption is only about 10 kg per year. Taiwan's per capita chicken consumption, which is closest to the diet structure of mainland residents, has reached about 28 kg, and the per capita chicken consumption in the United States and Brazil exceeds 40 kg per year. It is expected that China's chicken market will have more room for growth in the future.

Comparative chart of per capita chicken consumption in big countries of chicken production and marketing in the world

Source: USDA, China Business Industry Research Institute

V. Analysis of key enterprises in broiler breeding industry

1. Guangdong Wenshi Food Group Co., Ltd.

Guangdong Wenshi Food Group Co., Ltd.(hereinafter referred to as "Wenshi Shares"), founded in 1983, has developed into a cross-regional modern farming and animal husbandry enterprise group with livestock breeding as its main business and supporting related businesses. On November 2,2015, Wen's shares were listed on Shenzhen Stock Exchange.

As of December 31, 2016, Wen's shares have owned 239 holding companies, 58,600 cooperative family farms and more than 49,000 employees in more than 20 provinces (municipalities and autonomous regions) nationwide. In 2016, 17.13 million pork pigs, 819 million broilers and 26.26 million meat ducks were listed, with a total sales revenue of 59.4 billion yuan.

2012-2017 Income Statistics of Guangdong Wenshi Food Group Co., Ltd. in

Source: China Business Industry Research Institute

2. Fujian Shengnong Development Company Limited

Fujian Shengnong Development Co., Ltd. is a listed company listed on Shenzhen Stock Exchange, and its stock is referred to as "Shengnong Development". The company focuses on white chicken production for more than 30 years, and is a joint enterprise with the highest degree of modernization, the best quality and the largest scale in the same industry in China, integrating feed processing, ancestral and parental breeding, egg incubation, broiler breeding, broiler slaughtering and processing.

With a complete integrated whole industry chain, the company has achieved traceability of food safety, and has become KFC's long-term strategic partner by relying on excellent quality and stable supply. McDonald's is the only local chicken supplier in China, the designated chicken supplier for the 2008 Beijing Olympic Games, the 2010 Shanghai World Expo, the Guangzhou Asian Games, the 2011 Shenzhen Universiade, the first Youth Games in 2015 and the 2016 G20 Summit, as well as Shuanghui, Taitai Le, Anjing, Haibawang, Walmart, Metro, CR Vanguard, Century Lianhua, Yonghui and other food processing enterprises and large supermarkets important chicken suppliers.

In 2016, the company took the lead in opening the era of agricultural breeding 4.0 in the same industry, and plans to invest 1 billion yuan in 3 years to implement the agricultural breeding 4.0 system, realize intelligent management, production automation, food safety systematization, environmental protection and fire protection standardization, making the company one of the most advanced chicken production enterprises in the world. In 2016, the company realized revenue of RMB 8.34 billion yuan, an increase of 20.19% year-on-year; net profit of RMB 679 million yuan, a year-on-year loss of RMB 388 million yuan, and basic earnings per share of RMB 0.6115 yuan. Shengnong Development said in its announcement that its operating performance in 2016 had improved significantly, mainly due to the rise in the volume and price of chicken products, the decrease in feed costs, the improvement of production efficiency and the reduction of financial expenses.

2012-2017 Fujian Shengnong Development Co., Ltd. Income Statistics

Source: China Business Industry Research Institute

3. Shandong Minhe Animal Husbandry Company Limited

Shandong Minhe Animal Husbandry Co., Ltd. was formerly Shandong Penglai Fine Breed Broiler Demonstration Farm of Ministry of Agriculture. It was founded in 1985 and restructured in 1997. It has been recognized as a national key leading enterprise of agricultural industrialization, a national agricultural standardization demonstration zone, a national export chicken standardization demonstration zone, a national excellent animal husbandry enterprise, the first batch of national broiler biosafety isolation zones without highly pathogenic avian influenza, a vice chairman unit of China Animal Husbandry Association, a vice chairman unit of White Feather Broiler Alliance, Vice president unit of national livestock and poultry breeding waste recycling technology innovation alliance. In May 2008, the company's shares were successfully listed on the Shenzhen Stock Exchange, and Minhe shares also became the first listed company in the domestic white feather broiler industry.

At present, the company consists of breeding farms, hatcheries, feed factories, commodity chicken bases, food companies, import and export companies, biotechnology companies and other 54 production units. There are 3.3 million sets of parent broilers in the existing pens, more than 300 million commercial broilers hatched annually, more than 30 million commercial broilers produced annually, more than 60,000 tons of various chicken products slaughtered and divided annually, 400,000 tons of feed production capacity, more than 20 million kilowatt-hours of annual power generation from sewage methane, 15 million cubic meters of purified biogas, and an annual output of 50,000 tons of solid biological organic fertilizer and 160,000 tons of organic water-soluble fertilizer. The company has initially established a relatively perfect circular industrial chain integrating broiler breeding, slaughtering and processing, and organic waste resource development and utilization with parental broiler breeding and commercial broiler seedling production and sales as the core, realizing automation, intelligence, factory production and intensive management, and marching towards ecological balance, safety and environmental protection, high quality and high yield modern animal husbandry.

In 2016, the company realized operating income of RMB 1.409 billion yuan, an increase of 56.38% compared with last year; the net profit attributable to shareholders of listed companies was RMB 154 million yuan, an increase of 148.74% compared with last year. Basic earnings per share was 0.51 yuan, up 149.04% year-on-year; weighted average return on net assets was 16.13%, 46.63 percentage points year-on-year.

2012-2017 Income Statistics of Shandong Minhe Animal Husbandry Co., Ltd. in

Source: China Business Industry Research Institute

VI. Development trend of broiler breeding industry

In the past ten years, China's broiler industry has experienced multiple rounds of price cycles, with obvious price volatility characteristics, and the industry competition pattern tends to develop in the following aspects:

1. Resource integration of large enterprises in the industry accelerates

In recent years, due to policies such as large-scale breeding, intensive land use and industrial development requirements, the concentration of broiler breeding links has gradually increased. From the perspective of the whole industry chain, the higher the concentration degree of broiler breeding industry goes upstream, that is, the concentration degree of ancestral broiler breeding is greater than that of parental broiler breeding, and the concentration degree of parental broiler breeding is greater than that of commercial broiler breeding. Specific to the white feather broiler industry, after more than ten years of fierce market competition, the ancestral broiler breeding enterprises have been integrated from 40 in 1994 to 10 in 2015. According to the statistics of China Poultry Industry Development Report (2015), as of 2015, 10 enterprises in China have introduced ancestral white chickens from abroad, among which the market share of the three enterprises with the largest number of introductions is 60.11%. After experiencing H7N9 epidemic, raw material price increase, load limitation and national macro-economic regulation, parent broiler breeding industry is in the integration stage, shifting from small enterprises to large and medium-sized enterprises in scale, and gradually realizing large-scale and intensive production. The proportion of commercial broiler breeding scale has been rising continuously, from 67% in 2003 to more than 90% in 2014 (according to the data of China Animal Husbandry Yearbook, the scale definition is more than 2000 chickens per year), but the market concentration is low, and the output of the top ten enterprises accounts for less than 25%. For yellow feather broiler industry, with the gradual strengthening of product quality and safety supervision of the food processing industry by the state, the requirements for animal epidemic prevention and product quality hygiene are increasingly strict, and yellow feather broilers are turning from live poultry sales to slaughtering and processing, which also tends to be standardized and centralized. With a large number of small and medium-sized enterprises or small farmers forced to withdraw from the industry competition in the process of profit fluctuation, and large enterprises expanding and extending the industrial chain by using the mode of "company + farmer (or family farm)" or "company + base + farmer (or family farm)" and strengthening the strong alliance among large enterprises, the trend of increasing industry concentration is obvious, and the market share of regional leading enterprises is increasing. At this stage, the key points of competition of enterprises are reflected in the speed of capacity expansion, cost control ability and food safety control ability, among which the expansion speed will be the prerequisite basis for seizing the market in the future.

2. Integrated operation leads to expansion of business competition field

With the market prospects continue to improve and the rapid development of the industry, the domestic strength of the strong parents of yellow feather meat species

Chicken, commercial generation yellow feather broiler breeding enterprises gradually extended downstream to slaughter and processing business, large broiler slaughtering and processing enterprises also began to extend upstream, some enterprises also began to set foot in broiler breeding business. Compared with integrated operation, the business focuses on the single business link of yellow feather broiler breeding or commercial generation yellow feather broiler breeding or slaughtering processing, which is easy to be affected by factors such as raw material price, epidemic disease, market situation and consumer psychology, resulting in periodic or sudden fluctuation. Especially in the face of emergencies such as H7N9 epidemic, large enterprises with integrated operation can effectively resolve risks and achieve long-term stable development by virtue of strong financial strength and comprehensive disease prevention mechanism; while free-range households often choose to withdraw due to serious losses, or join the "company + farmer (or family farm)" model, which further promotes the upgrading of the scale level of the industry. While expanding the scale of the enterprise, the integrated operation effectively integrates and eliminates the risks within the industrial chain, avoids the fluctuation of enterprise performance, and enhances the stability and security of enterprise operation. These expansion models have led to a shift in competition faced by large yellow-feathered broiler breeding and slaughtering enterprises from single-link competition to integrated operation competition.

3. Industry leaders adjust business direction and promote transformation and upgrading

Yellow-feather broiler industry is a characteristic industry in poultry breeding in China, and has become one of the fastest growing industries in animal husbandry development in China in recent years. However, the processing proportion of yellow-feathered broiler products in China is relatively low. According to the statistics of China Poultry Industry Development Report (2014), live chicken products always dominate, accounting for about 85%, chilled chicken products only account for about 5%, and the remaining 10% are frozen chickens, gift boxes and deep-processed products. As the business performance of broiler breeding enterprises is vulnerable to macro-economic situation, cyclical supply and demand changes in the industry, animal diseases, industrial policies and other factors, and presents large fluctuations, especially from April 2013 to the beginning of 2014, due to the impact of H7N9 epidemic, the yellow feather broiler industry dominated by live chicken sales fell into deep difficulties, and the price of yellow feather broiler rose only after the industry significantly reduced production. At this point, many enterprises in the industry have realized that enterprises need to transform themselves with the development trend of the country's vigorous promotion of chilled listing and the gradual transformation of people's consumption concepts. Therefore, some large-scale enterprises take advantage of the rapid development trend of e-commerce to vigorously develop chilled products, continuously improve quality, strive to build chilled brands in the industry, expand influence and popularity, and hope to increase new profit growth points and enhance anti-risk ability through the development of chilled products.

- Prev

The scale of bamboo rat culture should be moderate.

I have been engaged in bamboo rat breeding for 8 years, in the process of recovering bamboo rats from bamboo rat farmers, in the process of door-to-door technical service, and in the process of visiting farmers.

- Next

Pumpkin seed, an ingenious use in raising native chickens

Because the native chicken is always in contact with the soil, coupled with some pigeon fanciers are busy with their own work or life, ignoring the cleaning of the local chicken activity site, resulting in some.

Related

- On the eggshell is a badge full of pride. British Poultry Egg Market and Consumer observation

- British study: 72% of Britons are willing to buy native eggs raised by insects

- Guidelines for friendly egg production revised the increase of space in chicken sheds can not be forced to change feathers and lay eggs.

- Risk of delay in customs clearance Australia suspends lobster exports to China

- Pig semen-the Vector of virus Transmission (4)

- Pig semen-the Vector of virus Transmission (3)

- Five common causes of difficult control of classical swine fever in clinic and their countermeasures

- Foot-and-mouth disease is the most effective way to prevent it!

- PED is the number one killer of piglets and has to be guarded against in autumn and winter.

- What is "yellow fat pig"? Have you ever heard the pig collector talk about "yellow fat pig"?