Chemical Fertilizer big data-- Market Analysis of Chemical Fertilizer Raw Materials in the first half of 2016

It is time to write a half-year summary once a year. What is the market situation of major chemical fertilizer products in the first half of 2016? let's see how this article tells you.

Summary of synthetic ammonia market

Looking back on how synthetic ammonia spent the past six months, I can't help but think of a piece of news I saw in moments a few days ago. If you don't achieve the expected goal in the first half of the year, please don't be disappointed and don't lose heart, because the party was founded on July 1st, the army was founded on August 1st, and the nation was founded on August 1st. Great undertakings were all accomplished in the second half of the year! I'm afraid this humorous sentence also speaks the hearts of many fertilizer people.

If we have to use one word to sum up the first half of synthetic ammonia, it is "twists and turns". Although there are many twists and turns, it failed to stop the overall downward trend.

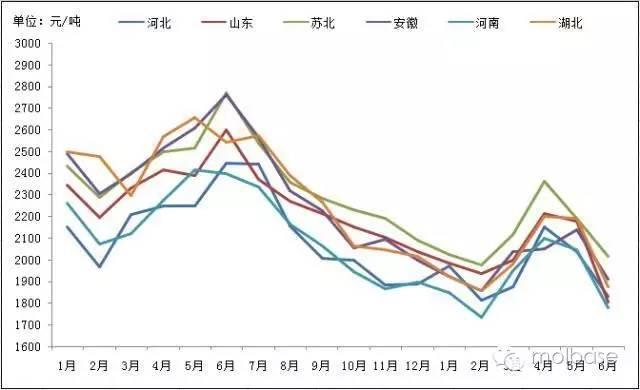

Regional price trend chart of synthetic ammonia from 2015 to now

It can be clearly seen from figure 1 that there is a large price difference between 2015 and 2016, with a price difference of 1030 yuan / ton between high-end and low-end ammonia, with an overall trend of "3 falls and 2 rises". The two low-end prices were both around February, and in terms of the price difference between the two years, the average price in February 2016 was 336 yuan / ton lower than last year, down 16.22% from the same period last year. The two-year high-end prices appeared in June and April respectively. Last year's high-end monthly average price was 410 yuan / ton higher than this year, down 14.8% from the same period last year.

However, the price of synthetic ammonia only had a prominent "hill" in the first half of this year. Since February, after two months of rise, the price has fallen sharply since April. Judging from the overall trend of last year, there is no support for the price of synthetic ammonia this year. From the chart, we can see that the price of synthetic ammonia has been falling all the way from June 2015 to February 2016, with no intention of rising. According to this trend, the high-end price this year may remain in April. According to Longzhong data, Hebei liquid ammonia has become the lowest price in nearly three years since 2014, and the market has not improved until July. The trend of synthetic ammonia in the second half of the year is not optimistic.

1 overhauled by the manufacturer but the supply is not reduced

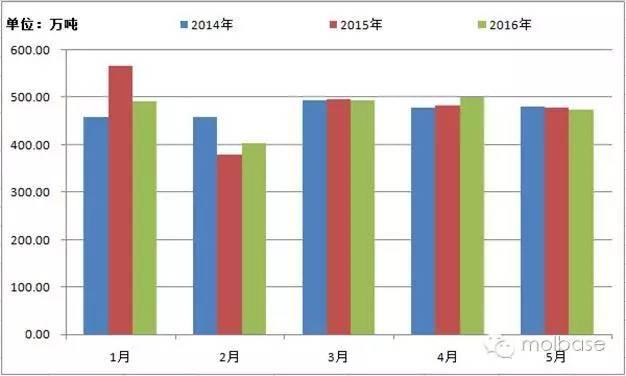

Statistical Chart of domestic synthetic ammonia supply from January to May from 2014 to 2016

The supply in figure 2 is the sum of monthly output and monthly imports. it can be felt from the trend chart that the supply generally changes greatly at the beginning of the year, and the supply has gradually stabilized since March. Although the June figures have not yet been released, we can also forecast from past trends to be about 4.85 million tonnes, down about 1.6 per cent from 4.93 million tonnes in the same period in 15 years.

In the whole process of operation in the first half of the year, although many manufacturers have carried out long-term or short-term maintenance, it seems that the overall supply of the market should have declined, except that some co-production enterprises are also releasing ammonia irregularly, in terms of imports, the import volume of synthetic ammonia in 2016 also became the largest import in the first half of the past three years. From January to May this year, imports of synthetic ammonia were 173400 tons, an increase of 10.8 percent over the same period last year of 156500 tons and a sharp increase of 114 percent over 81000 tons in 14 years. Under the influence of multiple factors, the overall supply of synthetic ammonia market is about the same as in previous years.

(2) the low demand for construction in the lower reaches did not increase, and the apparent consumption declined again in the next year.

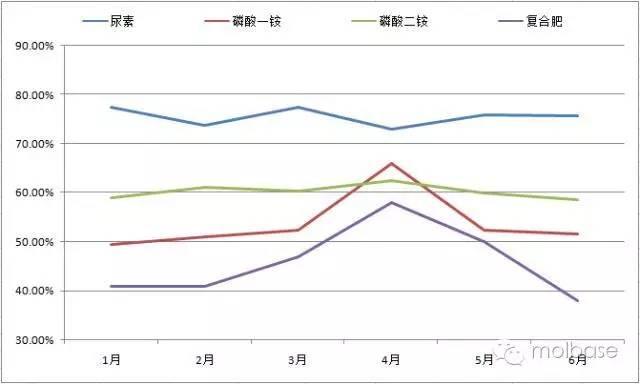

Start-up trend of downstream products of synthetic ammonia from January to June 2016

If you want to know the overall operation of the chemical fertilizer market in the first half of the year, you can probably see in figure 3 that urea, ammonium phosphate and compound fertilizers are all downstream industries of synthetic ammonia as well as bulk products of traditional chemical fertilizers. In the first six months of 2016, there were no products at full load, among which urea was the highest, which basically fluctuated at 75%, followed by diammonium phosphate at about 60%. Then, the start-up trend of monoammonium phosphate and compound fertilizer was similar, and the fluctuation frequency was basically the same, with a peak of 65% and 58% respectively in April. However, in terms of low operating rate, the lowest start-up rate of monoammonium phosphate in January is 50%. Take compound fertilizer, for example, the start of construction in the first half of the year was less than half of the time, with the lowest starting time in June being about 38%. How to support the normal operation of the raw material market with such a low operating rate, sales at reduced prices seem to be one of the solutions.

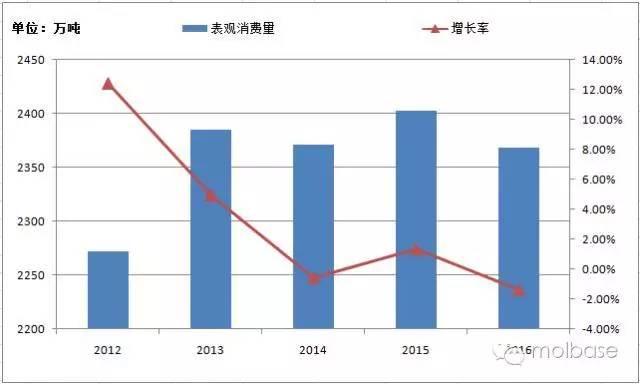

On the other hand, apparent consumption in the first half of 2016 was lower than last year. It is not difficult to see from figure 4 that the growth rate of the apparent consumption of synthetic ammonia is not considerable, with a downward growth rate from 2012 to 2014, with a slight increase in 15 years, but downward again in 2016. This performance is also showing that downstream demand is weakening and synthetic ammonia consumption is gradually flagging.

Statistical Chart of apparent consumption of synthetic ammonia in China from January to May from 2012 to 2016

3 how does the market go in the second half of the year? the small mood of synthetic ammonia may be difficult to close.

Summing up the synthetic ammonia market in the first half of the year, after bottoming out and rebounding after bottoming out, it also ushered in a "cool" summer after a smooth transition. How do you spend this autumn and winter? I am afraid that synthetic ammonia will continue to make "small emotions". The trend of soaring all the way is basically impossible, not a sharp decline may be the best outcome that manufacturers look forward to. Due to the influence of fertilizer reserve in autumn, it is possible to warm up slightly, but due to the influence of torrential rain, floods and other bad natural weather in the south, it is inevitable for enterprise production and terminal fertilizer preparation time to be postponed. Therefore, in the short term, people in the ammonia industry may have to accept the results of the weak line with tolerance, and at the same time still have a glimmer of hope. After all, "the great cause of ammonia synthesis in the second half of the year" still needs everyone's joint efforts.

Summary of the market of ammonium phosphate products

More than halfway through 2016, the market of monoammonium phosphate and diammonium phosphate did not rise in the first half of the year as it did last year, but stumbled down the road. Due to the depressed economic environment, the sharp decline in export volume, low grain prices, positive cultivation and the cautious mentality of buyers, the trading atmosphere in the ammonium phosphate market continues to weaken, and the focus of transaction continues to decrease. Up to now, the mainstream ex-factory quotation of 55 powder monoammonium is 1600-1700 yuan / ton, and the actual transaction is about 1600 yuan / ton. 64 diammonium mainstream ex-factory price is 2150-2200 yuan / ton, and the actual transaction price may be 100 yuan / ton lower than that at the beginning of the year.

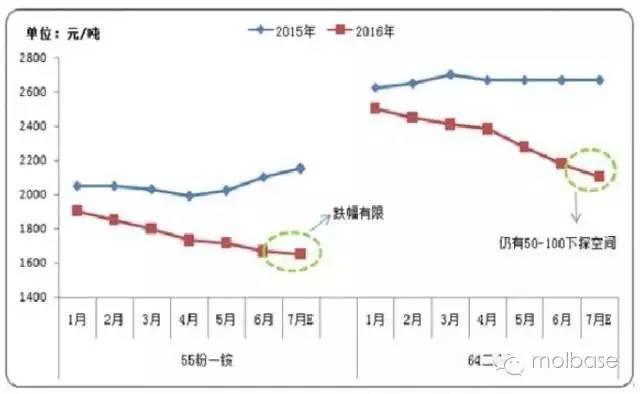

Comparison of monthly average prices of monoammonium phosphate and diammonium phosphate in China from 2015 to 2016

At present, the domestic ammonium phosphate market as a whole is in the middle of the off-season, and the operating rate of compound fertilizer downstream is low (4-50%). In addition, there is still time to prepare fertilizer in autumn, so the enthusiasm for purchasing monoammonium is not high; the purchasing mentality of agricultural capital merchants is cautious, and the market in the future is not clear. And worried about the large amount of funds, they dare not rashly reserve a large amount of inventory.

International price trend chart of ammonium phosphate in the first half of 2016

In the first half of the year, the international market price of ammonium phosphate also continued to decline, mainly due to the large import volume and large inventory of ammonium phosphate last year, as well as the low cost of the new process equipment in Middle Eastern countries such as Saudi Arabia and Oman, which depressed the export price of our country under the price advantage. By the end of June, the price of Baltic monoammonium FOB335-340USD / tonne, down 40 US dollars / tonne from the beginning of the year high of FOB375-380USD / tonne; diammonium FOB China 330333USD / tonne, down 60-67USD / tonne from the beginning of the year; India diammonium CFR340-345USD / tonne, also continued the downward trend, falling 65-68 US dollars / tonne from the beginning of the year.

Then, under the influence of the sharp decline in demand at home and abroad and the negative news that prices remain low, what will be the trend of diammonium phosphate in the later stage? Can the diammonium market regain its strength in the second half of the year? The author makes a simple analysis through the following aspects.

The output of ammonium phosphate increased and decreased steadily in the first half of the year.

Comparative chart of monoammonium phosphate and diammonium phosphate output from January to May from 2015 to 2016

As can be seen clearly from the above picture, the output of ammonium phosphate did not fluctuate significantly from 2015 to May 2016, while the production of monoammonium phosphate increased, and the output of diammonium phosphate was basically the same. From January to May, the total output of monoammonium phosphate was about 9.236 million tons, an increase of about 400000 tons over the same period last year, while that of diammonium phosphate was about 7.788 million tons, a slight decrease of about 62300 tons compared with the same period last year. Due to the off-season of traditional sales in June, coupled with poor export orders, enterprise plants have stopped production and reduced more, and it is estimated that the production of monoammonium phosphate and diammonium phosphate will each be reduced by 10-200000 tons.

2 the export volume of ammonium phosphate decreased significantly in the first half of the year.

Comparison of export volume of monoammonium phosphate and diammonium phosphate from January to May from 2015 to 2016

From January to May 2016, the total export volume of monoammonium was about 621800 tons, a sharp decrease of 552600 tons, or about 47.05%, compared with 1.1744 million tons in the same period last year, of which only 33300 tons were exported in February, and it is estimated that the export volume in June will be around 30, 000 tons. From January to May 2016, the total export volume of diammonium was about 1.3741 million tons, a decrease of about 748700 tons, or 35.27 percent, compared with 2.1228 million tons in the same period last year. The local production of ammonium phosphate in Morocco, Pakistan and India has increased, and the inventory is large, and the import quantity has shrunk. In addition, some new plants in the Middle East have advanced technology and low cost, and the quantity and price of goods in China are under pressure, resulting in a decrease in export volume.

List of the largest exporting countries of monoammonium phosphate and diammonium phosphate in 2015-2016

The amount of monoammonium phosphate and diammonium phosphate exported to Brazil and India decreased sharply in each month of 2016. As of May, the export of monoammonium phosphate and diammonium phosphate to Brazil and India has decreased by about 40-440000 tons.

(3) the profit margin of ammonium phosphate plant has been greatly reduced.

Profit and cost trend chart of 55 monoammonium powder in Hubei mainstream factories in the first half of 2016

Taking Hubei as an example, through the theoretical calculation formula to calculate and compare the quotation and cost, we can see that the ammonium profit space of Hubei monoammonium plant has already fallen below the cost line in the first half of the year, and is in a state of loss, with a maximum loss of nearly 70 yuan / ton. By the end of June, the price of sulfur in the upper reaches of the Yangtze River Port had dropped to the lowest of 670 yuan / ton in half a year, the price of liquid ammonia in Hubei was around 1850 yuan / ton, and the price of phosphate ore was stable at about 400 yuan / ton. although the cost has been reduced, the transaction price of monoammonium is on the low side and is still in the process of hanging upside down.

Profit and cost trend chart of 64 diammonium in Hubei mainstream factories in the first half of 2016

Taking Hubei as an example, through the theoretical calculation formula, the comparison of quotation and cost shows that the profit of Hubei diammonium plant is better than monoammonium phosphate in the first half of the year, but the mainstream price does not fall below the cost line, but the market price is affected by the slump in demand. it is chaotic, some factories with high inventory or capital difficulties, there is no lack of transactions below the market price in order to withdraw funds as soon as possible. However, compared with the arrival price of about 1998 yuan / ton of exports, there is still some profit in the domestic diammonium price.

Through the above analysis, the author is not optimistic about the future of ammonium phosphate market. First of all, in previous years, it should be the peak season of international demand after May, and the export volume will also continue to increase, but at present, China's port inventory is still increasing, and new export orders are rarely heard of. It is reported that the Indian port inventory is around 2 million tons, and its purchasing enthusiasm is still not high. Secondly, although the amount of high-phosphate fertilizer used in autumn is at least twice higher than that in summer, it still accounts for a minority under the overall overcapacity, and the social stock is still not a small number. The stock of Wengfu in Guizhou is only about 90,000 tons in Shandong market. Finally, the expected winter storage market has been shrinking in recent years, which may give a little boost to the downturn, but it was difficult to reach the expected number last year.

To sum up, under the great reduction in the volume of exports and the suppression of low prices, even if the market for fertilizer use in autumn and diammonium storage in winter can be improved, and the market may bring a turnaround, it will be difficult to improve by a large margin. Monoammonium phosphate, diammonium phosphate or only 50-100 yuan / ton increase.

Summary of potash fertilizer market

Introduction: time is in a hurry like running water, and half a year is fleeting. In the first half of 2016, the potash market was so-called mixed, and the situation of oversupply in the market still remained unabated. In January-February overall weak demand, the market trading is very little, showing a downward trend, the market is calm. The demand for fertilizer in downstream factories reached a small peak from March to May, but the market quickly entered a flat period after the demand.

1 Review of market

Price trend of domestic potassium Chloride in half a year

In terms of potassium chloride, the supply of goods in the port has been consumed to about 1.6 million tons in the first half of the year, and although the overall price has declined, the dealers still have a strong sense of price; the overall overshipment volume of border trade is relatively small, in addition to normally meeting the needs of the northeast market, a small amount of export, mainly in Shandong and North China markets, prices remain low, goods are relatively smooth. The self-sufficiency capacity of potassium chloride in China has increased slightly, and the output has increased by about 12% in the first half of last year, coupled with the high port inventory, so the supply of potassium chloride in China has been in the situation of oversupply. In particular, the annual large contract concerned by the industry has not been finalized all the time, and it is rumored that it will be signed at the end of this month or early next month in CFR200 US dollars / ton. The wait-and-see atmosphere in the industry is relatively strong.

Half-year trend of potassium Sulfate in China

In terms of potassium sulfate, 51% of Xinjiang Luo potassium powder was raised by 50 yuan after the end of the year, in an attempt to drive the overall downturn of potassium sulfate, but the actual situation shows that shipments are mediocre and trading is lukewarm, but Mannheim factories around the country play a psychological supporting role. Affected by spring ploughing, the market trading situation has gradually improved, and manufacturers' goods are relatively smooth, especially grain sales are good, but with the end of spring ploughing fertilizer, the market has entered the off-season, demand has shrunk, factory inventory has begun to increase, and sales pressure has gradually increased. Potassium sulfate prices continue to fall into the industry consensus. By the end of June, the price of 50% powder of Mannheim process has fallen to 2250 yuan / ton, basically near the cost line.

2 Forecast for the second half of the year

Potassium chloride

At the beginning of July, the potassium chloride market is basically at a standstill, the start-up of large-scale domestic potassium factories is relatively stable, small factories have been in the maintenance stage, there is no plan to resume production. Salt Lake Group officially maintained a higher quotation in the previous period, and the actual turnover in each region was mostly 1900-1950 yuan / ton, with a small trading volume. In the port, large dealers restrict the sale of goods, and the price is relatively stable. The price of 62% Russian white powder is 2070-2100 yuan / ton, the price of Baijing is 1950-1980 yuan / ton, and the price of 60% Russian red is 1800 yuan / ton. It is reported that the supply of goods in the bonded area has reached more than one million tons, and the uncertainty of the large contract has led to the fact that the source of goods cannot be sold on shore for the time being. In the border trade area, the supply of goods will arrive around the end of the month in July, and it is reported that pre-sale has begun. 62% of Russian Baijing quotes at 1720-1750 yuan / ton. According to the current market, forecast the trend of potassium chloride in the second half of the year.

1. On the supply side, it is reported that in the first quarter of 2016, Ural Potash Company's total production of potassium chloride was 2.6 million tons, down 100000 tons from the same period last year, mainly due to the poor market environment. Despite production restrictions, the company's potash stock increased by 350000 tons at the end of March compared with the same period in 2015. China's cumulative potash output from January to May was 2.412 million tons, an increase of 11.7 percent over the 2.159 million tons in the same period last year. In addition, the supply of goods in the port bonded area has been more than one million tons, once the large contract is signed, the port inventory is still at its peak. On the whole, although the international market of potassium chloride has declined slightly, the overall inventory is still large, and the output of the domestic market has been increasing continuously.

two。 On the demand side, the launch of the fertilizer market in the autumn of July and August will drive the demand for raw materials from light to prosperous. However, due to the decline in wheat prices, the amount of fertilizer used at the grass-roots level will be affected to a certain extent, so dealers hold money and wait and see, and ammonium phosphate is the main raw material for fertilizer in autumn, which leads to the fact that compound fertilizer manufacturers are not active in preparing potash fertilizer. As the low grain prices and the adjustment of planting structure this year are bound to affect the enthusiasm of farmers, it is expected that the demand for potassium chloride market in the second half of this year will not be higher than that in the same period last year.

Potassium sulfate

At the beginning of July, the domestic potassium sulfate market remained stable and did not change much. The operating rate of the Mannheim plant has always been maintained at about 50-60%. Although a small number of enterprises have plans to resume production, the range is limited and there is no great support for the market. The quotation of the manufacturer is still strong, but the actual transaction is low, and the price of 50% powder mainstream factory is 2250-2300 yuan / ton. The powder price of Qinghai water and salt system is about 2100 yuan / ton, and the preferential range is about 50-80 yuan / ton. The ad valorem levy of resource tax was implemented in July, which has significantly reduced the cost of resource-based enterprises, but GIC Luo potassium said that before the plant resumes production, there will be no price adjustment plan for the time being, and the price will still be quoted at the station at 2350 yuan per ton. According to the current market, forecast the trend of potassium sulfate in the second half of the year.

1. On the supply side, the overall operation of the Mannheim process plant in the first half of the year is maintained at 50-60%, the production capacity is relatively sufficient, and some enterprises still have inventory. The output of potassium in China Investment Luo is stable, with a planned production capacity of about 1.6 million tons this year. The equipment of Qinghai resource-based manufacturers is running normally, but it is trapped by the bad market, which leads to the slow release of production capacity.

two。 On the demand side, fertilizer will gradually enter into production in autumn after mid-July, and the demand for potassium sulfate will pick up slowly, but the price of cash crops is low, farmers do not use fertilizer actively, and the planting area of tobacco is reduced by the state. Taken together, it is unlikely that the demand for potassium sulfate will increase significantly in the second half of the year.

To sum up, the price trend of potash market in the second half of the year still depends on the changes in supply and demand, whether there will be a turning point, and whether downstream demand will increase. Potash market trend is expected to stabilize in the second half of the year, once a large contract is signed, potash increment will gradually enlarge, even if the demand support is still there, the price decline is difficult to change.

(source: buildings love farmers)

Dear chemical industry enthusiasts, follow me (WeChat account: MOLBASE), the wonderful information of the global chemical industry continues to send to you!

- Prev

How is ginger grown? Cultivation techniques of ginger

How to grow ginger? Ginger has many functions in food and medicine. How to grow ginger? What are the cultivation techniques of ginger? How can I help you?

- Next

The harm of Pesticide Chemical Fertilizer: chemical Fertilizer can also be used as Pesticide? Excessive harm of chemical fertilizer to soil

One of the biggest problems in agricultural production is the problem of diseases, insect pests and weeds. If you want to control diseases, pests and weeds, pesticides are essential, and pesticides have one.

Related

- Fuxing push coffee new agricultural production and marketing class: lack of small-scale processing plants

- Jujube rice field leisure farm deep ploughing Yilan for five years to create a space for organic food and play

- Nongyu Farm-A trial of organic papaya for brave women with advanced technology

- Four points for attention in the prevention and control of diseases and insect pests of edible fungi

- How to add nutrient solution to Edible Fungi

- Is there any good way to control edible fungus mites?

- Open Inoculation Technology of Edible Fungi

- Is there any clever way to use fertilizer for edible fungus in winter?

- What agents are used to kill the pathogens of edible fungi in the mushroom shed?

- Rapid drying of Edible Fungi