The latest policy on rural land! Peasant friends, take a quick look.

"What the village says" agricultural highlights:

Recently, as an important measure to conscientiously implement the pilot work of the CPC Central Committee and the State Council to promote the reform of rural collective operating construction land entering the market, the CBRC and the Ministry of Land and Resources jointly issued the Interim Measures for the Administration of Mortgage Loans for the Use Right of Rural Collective Operating Construction Land, which clearly stipulates that in 15 pilot areas of cities (counties), the requirements for meeting the planning, use control and legal acquisition shall be transferred, leased, The right to use rural collective construction land for business purposes that enters the market by way of capital contribution (equity) and meets the conditions for entering the market may apply for mortgage loans.

Simply put, rural land can be loaned! As for the fixed assets that have been sleeping in the countryside, now they can finally become "living money". In fact, these days,"Native Life" has been paying attention to the problem of rural land use. Many farmers 'friends reflect that the money sold for current agricultural products cannot reach the oil money on the road. Therefore, how to use land reasonably is already a huge problem in front of farmers' friends. Now, the introduction of this policy is undoubtedly good news.

The policy has just been issued and is currently being piloted nationwide. It is believed that it will spread throughout the country in the later period.

Which areas can be piloted?

The Measures clearly define the applicable area, applicable land category and validity period.

For the applicable areas, the Measures clearly allow mortgage loans to be carried out in rural collective construction land limited to 15 pilot counties (cities, districts) determined by the state, including Beijing City, Daxing District, Shanxi Province, Jincheng City, Zezhou County, Liaoning Province, Anshan City, Haicheng City, etc.

For the applicable land categories, the Measures clearly define that rural collective construction land refers to the land determined for industrial and mining storage, commercial service and other business purposes in the overall land use planning and urban and rural planning among the stock rural collective construction land, and stipulates that the right to use rural collective construction land entering the market by means of transfer, lease, pricing (equity) and meeting the conditions for entering the market can apply for mortgage loans.

As for the validity period, the Measures stipulate that the validity period shall expire on December 31,2017, which shall be consistent with the time limit for the pilot entry of rural collective construction land into the market.

According to the Measures, mortgage loans for the use right of rural collective construction land should be carried out on the premise of maintaining the nature of land ownership unchanged, not breaking through the red line of cultivated land and not damaging farmers 'interests. At the same time, it is required that the mortgage loan for the use right of rural collective construction land shall adhere to the principles of compliance with laws, benefiting farmers and benefiting the people, equality and voluntariness, fairness and integrity, controllable risks and commercial sustainability.

Which land use rights can be mortgaged?

The Measures clearly stipulate the mortgage loan business of rural collective operating construction land use right from the aspects of business scope, loan use, conditions, process, risk guarantee mechanism, etc.

For the scope of collateral, the Measures allow mortgage financing of two types of rural collective construction land use rights with disposition rights. One is the right to use collective operating construction land obtained by way of transfer, lease and capital contribution (equity); the other is the right to use rural collective operating construction land that has not yet entered the market but has the conditions for entering the market.

There are two kinds of conditions for entering the market: one is that the real estate has not entered the market but has been registered according to law and holds the ownership certificate, meets the requirements of planning and environmental protection, meets the basic conditions for development and utilization, the ownership subject performs the decision-making procedure of collective land assets and agrees to mortgage, and the pilot county (city, district) government agrees that the land can enter the market when the mortgage right is realized; The other category is the rural collective construction land that has not yet entered the market but was used according to law before the reform. The real estate registration shall be carried out according to law and the ownership certificate shall be held. According to relevant regulations, the procedures for entering the market shall be handled, the land use contract shall be signed, and the registration formalities for change shall be handled.

At the same time, the Measures stipulate that the right to use collective construction land for business shall not be mortgaged: the ownership is unclear or disputed; the judicial organs shall seal it up according to law; it shall be included in the scope of demolition land requisition according to law; the use shall be changed without authorization; and other circumstances in which mortgage shall not be handled.

What to do with collateral if default occurs

Strictly controlling loan conditions is a necessary means to control loan risks and smoothly promote mortgage loan business of collective operating construction land use right in pilot areas. The Measures put forward requirements from the aspects of holding land use right certificate according to law, conforming to the overall land planning and urban and rural planning, and other rights without priority for compensation, and require banking financial institutions to conduct detailed investigation on whether the borrower has qualification, whether the ownership of collateral is clear, whether the value evaluation is reasonable, whether it conforms to the planning, and whether it is easy to dispose and realize, so as to prevent loan risks and improve asset quality.

How to evaluate collateral value? The Measures stipulate that banking financial institutions shall establish a system for evaluating the value of rural collective construction land use rights. External or internal evaluation can be adopted to evaluate the value of the rural collective construction land use right used for mortgage. At the same time, it stipulates that banking financial institutions shall strengthen the dynamic management and revaluation of collateral in accordance with the mortgage contract, so as to ensure the authenticity, legality, full value and effectiveness of mortgage rights.

Loan default, how to dispose of collateral? The Measures stipulate that after the loan expires, if the borrower fails to pay off the debts or the mortgage right is realized as agreed by the parties concerned, the banking financial institution may dispose of the mortgaged rural collective construction land use right through legal means such as discount, auction and sale of mortgaged property. The proceeds shall be paid in priority by banking financial institutions.

In addition, the Measures also establish a mortgage loan guarantee mechanism system for collective operating construction land use rights from the aspects of government financing guarantee company guarantee and risk compensation mechanism, which is conducive to sharing the risks of banking financial institutions and promoting the development of mortgage loan pilot work for collective operating construction land use rights.

The policy issued this time is to bring more income conditions to farmers and adjust the land use structure as the strategic point to carry out further rural land reform. I hope more farmers can take action when reading this article. Read the content of this article carefully and start to do it.

This article was originally published by "Native Chinese Life" and reproduced with my consent.

Tomorrow's announcement: how to maximize the benefits of current land use? (Interested in tomorrow's content can subscribe to this headline number in advance)

- Prev

The baby accompanies grandpa to collect wheat. When he comes back, he says a word, and his mother tears.

The baby accompanies grandpa to collect wheat. When he comes back, he says a word, and his mother tears.

- Next

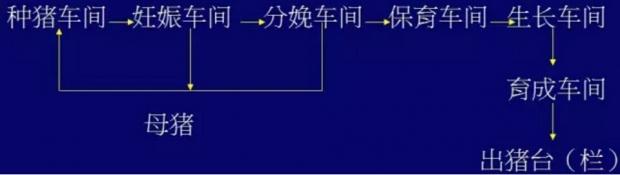

Design idea of Wantou Pig Farm and Pig herd structure

Design idea of Wantou Pig Farm and Pig herd structure

Related

- A course of planting techniques and methods on how to grow carrots

- How to plant the latest tulips?

- Is it better to pick tea in the morning or in the afternoon? When is the best time for tea to be picked? what is the third or fifth tea?

- Launch Yuanxiao Happy combination Haocha + Tea Yuan healthy Taste

- Penghu Tourism "Fireworks 20 Parade with You"

- 2022 West Lake Happiness holds "Digital Revitalization Voucher" and draws iphone13 and laptop.

- Banqiao Fuzhou social houses are designed to change start-up combined with police elimination to create a safe and livable environment

- The convenient measure of "mechanical weeding" in Xinbei has been abused and the Agriculture Bureau has imposed heavy penalties on the illegal land consolidation.

- Changgeng University Joins Hands with Four Memory Factories to Rescue Memory Talent Shortage

- The list of Taiwan's top 100 MVP managers is listed by the Director-General of the Farmers' Association of Sanxia District.