Yi Gang: the people's Bank of China plans to implement a system of compulsory disclosure of climate information.

The people's Bank of China will support the development of a standardized international climate reporting framework, further improve the classification of green bonds with the European Union and the United States, and plan to implement mandatory disclosure of climate-related information, urge major domestic commercial banks to disclose carbon information, and then supervise the relevant disclosure activities of domestic listed companies.

Mr Yi, who attended the 2021 Green Swan meeting organised by the Bank for International Settlements (BIS) yesterday, said the PBoC was working closely with the Financial Stability Council (FSB) to encourage domestic banks and institutions to join the working Group on Climate-related Financial Disclosure (TCFD). The people's Bank of China is now cooperating with the European Union on green loans and green bonds, while further disclosing climate-related information under the framework of TCFD.

He said that China's domestic green bond standards are 80% consistent with EU standards, and the people's Bank of China will explore internationally recognized standards. at the same time, the central bank plans to implement mandatory disclosure of climate-related information, urge major domestic commercial banks to disclose carbon information, and then urge domestic listed companies to disclose relevant information.

Yi Gang pointed out that in the financial sector, Chinese banks will continue to conduct climate stress tests to measure climate-related risks. With regard to the G-7 leaders' meeting in the UK next week and the G20, he hopes that countries can reach an information disclosure standard by the end of this year.

In order to identify and assess the institutions most vulnerable to climate change, the people's Bank of China has begun climate stress tests on China's financial system, but the results of the analysis have not yet been released, he said.

Yi Gang said that the results of climate risk assessment will be disclosed in due course in the future, and commercial banks have already begun to assess them in pilot projects, such as macro-prudential policies, while the former is gradually realizing the importance of climate change. The people's Bank of China is trying to evaluate the green and brown assets of commercial banks and may consider risk weighting based on the greenness of the assets in the future. The deadline for the green transformation of commercial banks will be determined in the future, but the transformation needs to be carried out smoothly to avoid a crisis caused by sudden actions.

- Prev

The counterattack of grapes, fruits and vegetables, pineapple, sweet potato, etc., are also following the surge in subscription.

When the grapes were ripe, there was an unexpected epidemic, which once made the fruit farmers want to cry without tears, but the grapes were innocent and had high nutritional value, which was a good product of the war plague. All walks of life in Changhua County promoted grapes through various channels, and good news spread frequently. Zhangxian government integrated various peasant associations and young farmers to provide

- Next

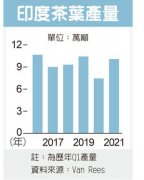

Drought + epidemic situation Darjeeling black tea production in India continues to rise

Under the impact of the dry weather and the COVID-19 epidemic, the harvest season in India's important tea-producing areas is facing the double threat of declining production and stagnant tea production, which may cause tea prices, which have already risen for a wave, to continue to rise. The Financial Times (FT) reports

Related

- A one-day flower show brings 130 million yuan in orders! Nanhai, this Phalaenopsis exhibition is amazing

- What do the flower language and meaning of Lutheran tree mean? Precautions for planting Lutheran tree

- Encounter Chaoshan Kongfu tea, not without this cup of Phoenix single clump

- The durian market in Vietnam and Thailand is flooded. The price of imported durian has plummeted by 30-40% in a month.

- Shanghai solved the problem of local vegetable supply by planting 80,000 mu of green leafy vegetables.

- Wageningen University has become the best agricultural university in the world for the seventh time in a row.

- The strongest export season of South African grapes is full of challenges, with exports to Russia falling sharply by 21%.

- Sri Lanka is on the verge of bankruptcy, "Tea for debt" Organic Agriculture Revolution aggravates the Food crisis?

- Turning waste into earthworm manure and worm manure into organic fertilizer-A new choice for auxiliary farming

- Organic rice growers shoulder the responsibility of nurturing agricultural talents! Yinchuan Sustainable Farm with Organic Life Camp